Idea of the Week

As the S&P 500 Index (SPX) approaches its highs, we are looking for stocks with compelling breakouts as long ideas. We found a mid-cap retailer that is making new highs with momentum to the upside in absolute and relative terms.

Did you know we offer a full suite of technical analysis research covering all asset classes? Click below for a free trial.

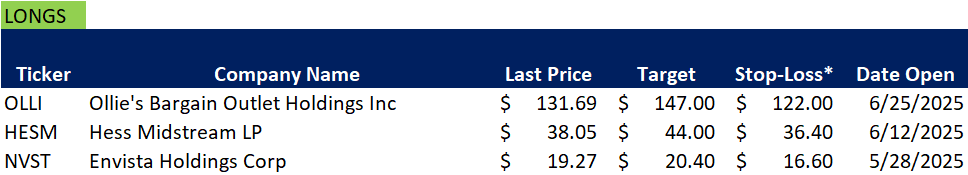

Today’s new long idea is outlet store Ollie’s Bargain Outlet Holdings, Inc. OLLI 0.00%↑ :

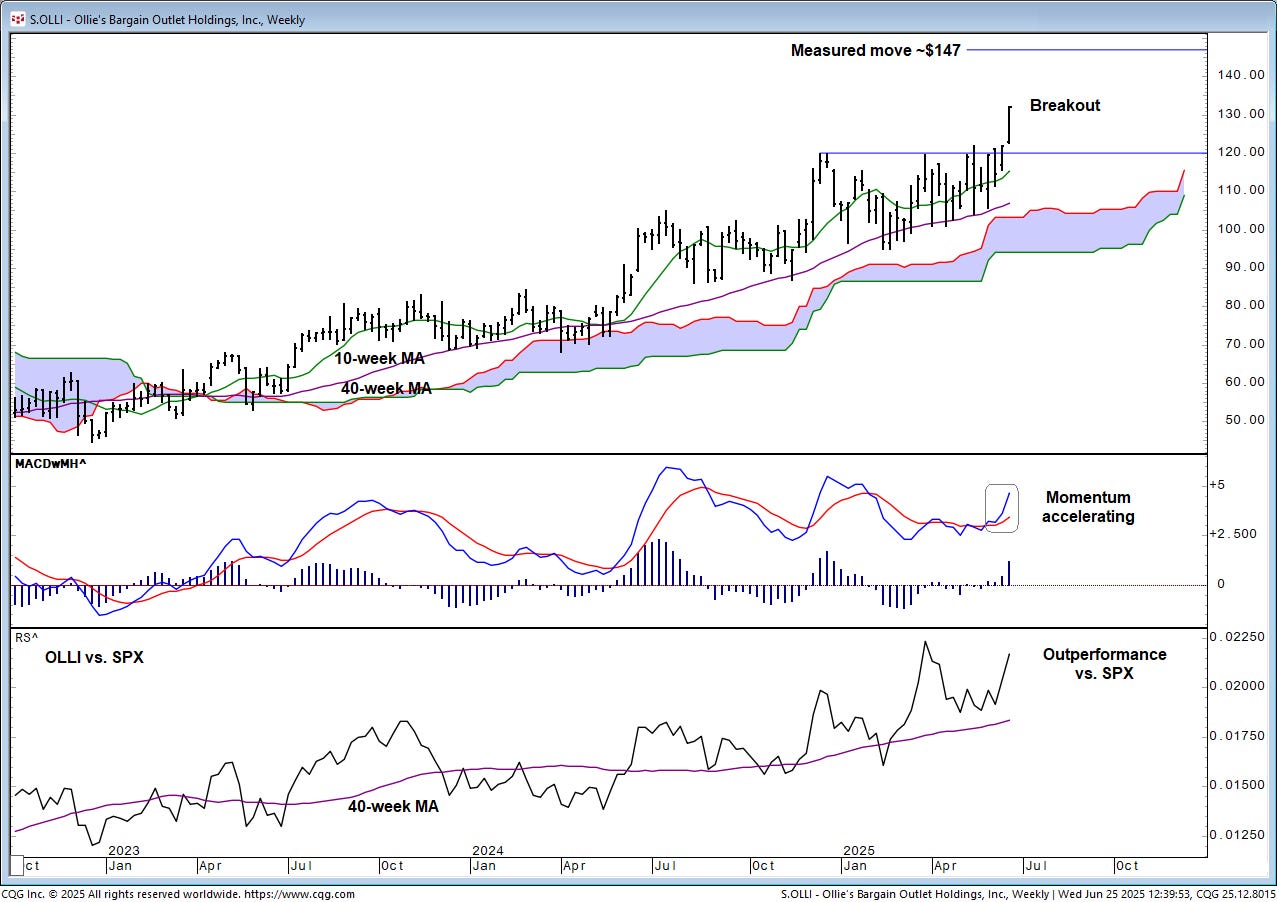

OLLI has benefited from a multi-year secular uptrend and is now extending its rally to new all-time highs. These levels have been achieved following a recent breakout above resistance near $120, and OLLI appears poised to build on this momentum in the intermediate term.

Momentum has accelerated as a result of the breakout, suggesting that the upmove can be sustained. Relative to the SPX, OLLI continues to exhibit a long-term trend of outperformance. The recent breakout is mirrored in the relative strength ratio, where a short-term rally is working toward a higher high, reinforcing the longer-term trend.

A measured move target of ~$147 can be derived for OLLI using a Fibonacci extension, projecting the width of the recent range higher. A stop-loss level can be placed near the recent gap up point around $122, below which the breakout would look false.

Chart & Levels

Ollie’s Bargain Outlet Holdings, Inc. OLLI 0.00%↑: Weekly Bar Chart + 10- & 40-week Moving Averages + Cloud Model + MACD Indicator w/Histogram + Ratio vs. SPX

Upside Target: $147

Stop-Loss*: $122

* Our stop-loss discipline requires two consecutive daily closes above/below the indicated level, unless stated otherwise.

Updates on Existing Ideas

We tightened our stop-loss in NVST to $18.25 from $16.60.

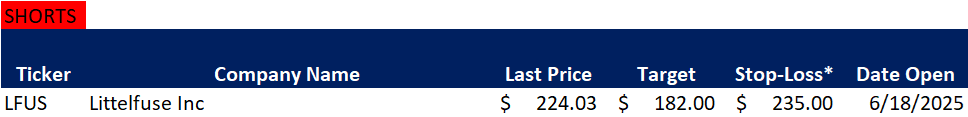

Open Ideas from Past Posts