This Wednesday, I’ll be joining Austin Hankwitz for a livestream at 12pm ET - it’s completely free - please register here. We’ll be looking at charts of stocks to leverage some of the biggest fundamental themes he’s investing in for 2022.

The Santa Claus rally has come to town, and we don’t expect it to be too picky. Higher-beta stocks should do best near-term, albeit not as promising intermediate-term.

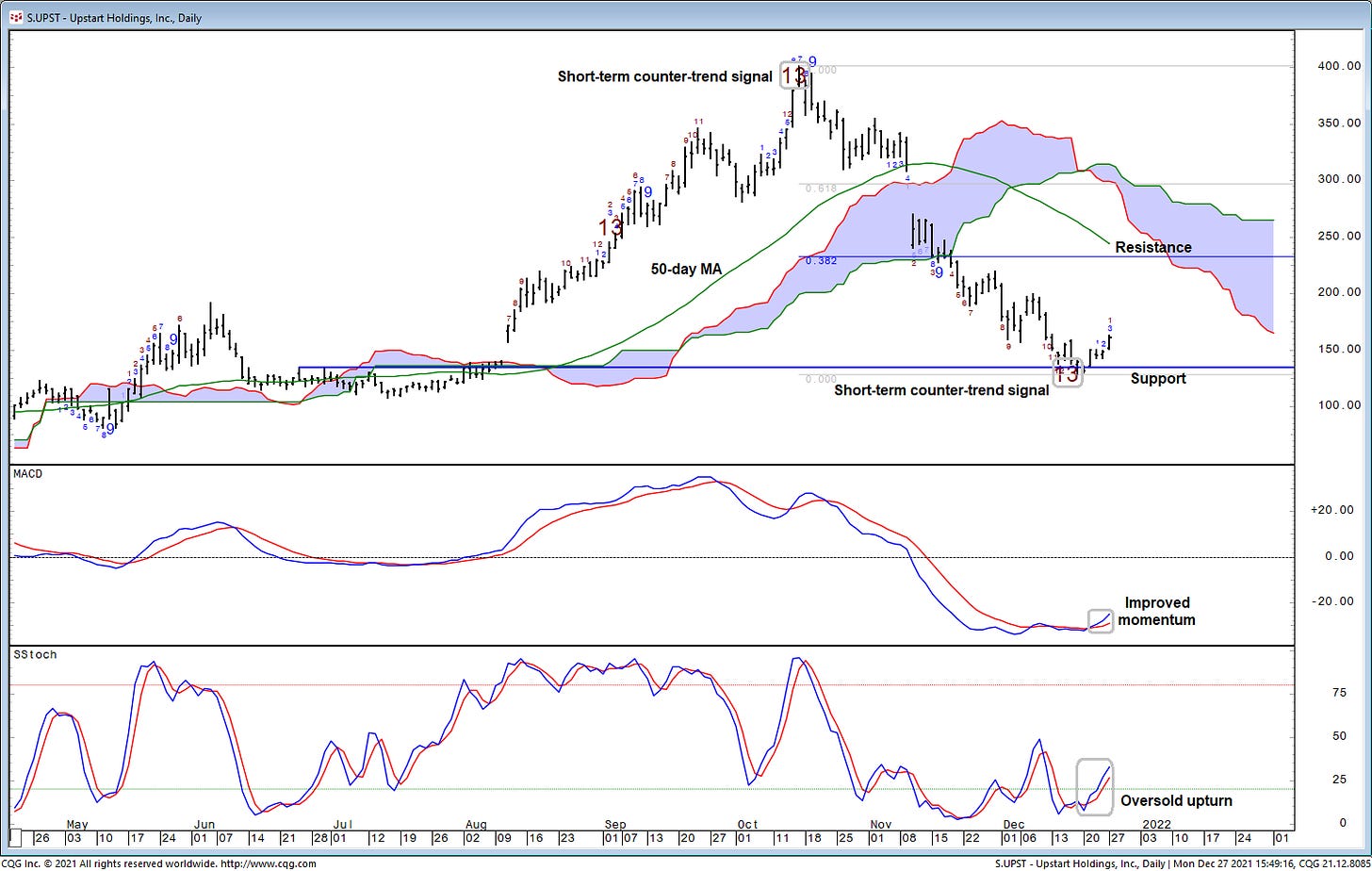

We believe Upstart Holdings (UPST) may be a source of short-term relative strength:

UPST has logged a short-term counter-trend signal per the DeMARK Indicators following a 68% downdraft. The signal affirms oversold conditions, and should give way to further improvement in short-term momentum.

The setup is somewhat similar to Paylocity (PCTY), which we highlighted last week. The daily MACD indicator supports a greater relief rally, and there is no strong resistance nearby.

Support is near $135, based on former resistance, so this idea holds more risk than average. However, the upside potential also appears greater than average, noting a 38.2% Fibonacci retracement of the downdraft would lift UPST to ~$233.

Upstart Holdings (UPST, $160.039)

Target: $233

Stop Loss: $135