Our newest long idea is PepsiCo (PEP), which looks for a rebound in the coming months after underperforming in January…

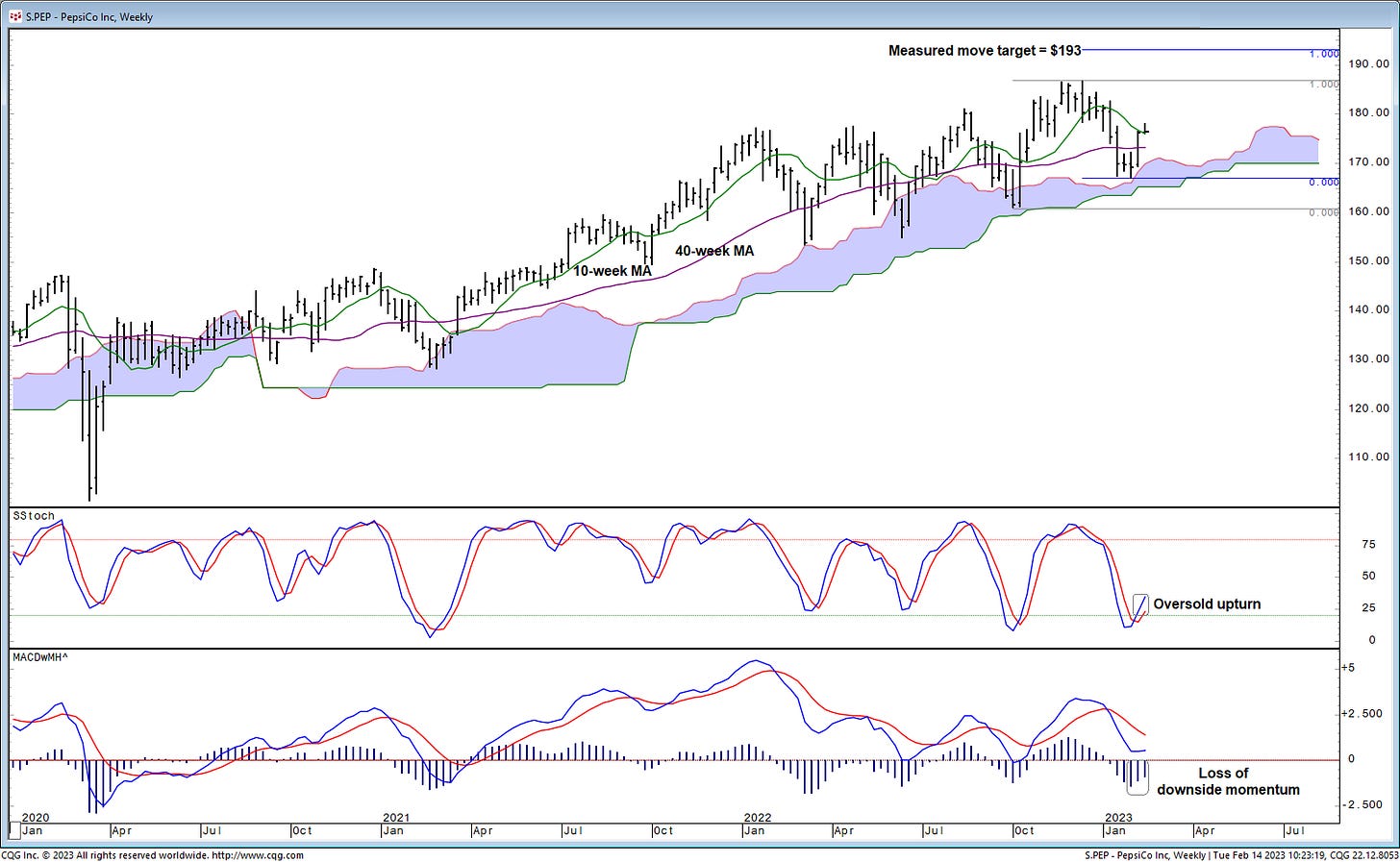

PEP has an intermediate-term oversold upturn from the weekly stochastics near long-term cloud-based support (shaded area on the chart), offering a compelling entry point within the long-term uptrend.

After being out of favor in January, PEP looks poised for a phase of outperformance, noting it has seen a positive reaction to a counter-trend “buy” signal from the DeMARK Indicators® in its ratio versus the S&P 500 Index (SPX).

A measured move projects an intermediate-term target of $193 for PEP, assuming it ultimately clears final resistance near $187. The bottom of last week’s earnings gap, near $171, can be used as a stop-loss on consecutive closes below.

PepsiCo (PEP, $175.27)

Target: $193

Stop-Loss: $171

Fairlead Idea Generator is a key validator for me along with other old school analysts & investment rating platforms, which provides me with confirmations of my trades per Fairlead’s timely proprietary chart analysis!