Idea of the Week

We are seeing more stocks with counter-trend ‘buy’ signals from the DeMARK Indicators® that suggest a tradable short-term relief rally is taking hold. We found a compelling signal in a large-cap semiconductor stock for today’s idea.

Did you know we publish ten research reports weekly? Click below for a free sample of one of our latest Fairlead Tactics report, and let us know if we can set up a trial for you.

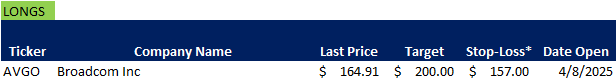

We are adding Broadcom Inc. (AVGO) as a short-term long idea:

AVGO has seen a severe correction, taking it below its 200-day moving average (MA) in a long-term setback. In the short-term, however, the downmove looks overdone. There are dual counter-trend ‘buy’ signals from the DeMARK Indicators® that support a minimum two-week rebound.

AVGO is a high-beta semiconductor stock, meaning that it should exhibit downside leadership during corrections and short-term upside leadership during rallies. There are also counter-trend signals in the ratio of AVGO to the S&P 500 Index (500), supporting outperformance in the near term.

A short-term upside objective for AVGO is in the $196-$200 area, based on former peaks and troughs, the 50-day MA, and daily cloud model. There is support from the weekly cloud (not shown) near $157 that can be used to manage downside risk.

Chart & Levels

Broadcom Inc. (AVGO, $164.91): Daily Bar Chart + 50- & 200-day MAs + Cloud Model + TD Sequential® Model + Stochastic Oscillator + Relative Strength

Target: $196-$200

Stop-Loss*: $157

* Our stop-loss discipline requires two consecutive daily closes above/below the indicated level, unless stated otherwise.

Updates on Existing Ideas

Shake Shack (SHAK) and Wyndham Hotels (WH) both broke support, so we would use a rebound over the next week or two to close long positions.

Reduce long exposure to Casella Waste Systems (CWST), the Global X Silver Miners ETF (SIL), and the United States Natural Gas Fund (UNG), all of which broke down below their 50-day MAs.

Open Ideas from Past Posts